Warren Buffett Has Left the Building. Enter Lumesis.

Posted by | August 23, 2012

Despite what many believe about Meredith Whitney’s prediction regarding the $3 trillion municipal bond market being a house of cards about to topple, you can’t help but take notice when the headlines tell you that Warren Buffett has officially exited the municipal bond business.

What is happening in this market which was previously seen as a safe haven? It’s simple—we have a “Eurozone-type crisis” in the U.S. at the state and municipal level with too many miniature Greeces, Spains, and Italys. Tax bases have been lowered; there is the prospect of cuts by the Federal government which will impact States; and municipalities and pensions have mushroomed out of control.

Lumesis, an interactive, web-based, fixed-income research tool for the municipal market (and a Safeguard Scientifics partner company), just released a research note explaining the problem. Today, the unfunded portion of pension liabilities for states is calculated at $776 billion. The problem with this number is that it assumes that state and municipal pensions will be receiving an 8 percent return on their investment portfolio. The average for pension funds is actually running at 5.5 percent, and when you use this rate of investment return, the unfunded liability is actually $2.2 trillion, according to recent commentary provided by Stephanie Pomboy.

What this means for the market is that investors need to carefully select the muni bonds they are investing in. Individuals and institutions can no longer rely on ratings or insurance. The ratings agencies have been discredited, Dodd Frank requires more, muni insurance has evaporated to less than 10 percent of new issuance and many of the former players have been taken over by regulators or are folding up tent like Warren Buffet just did.

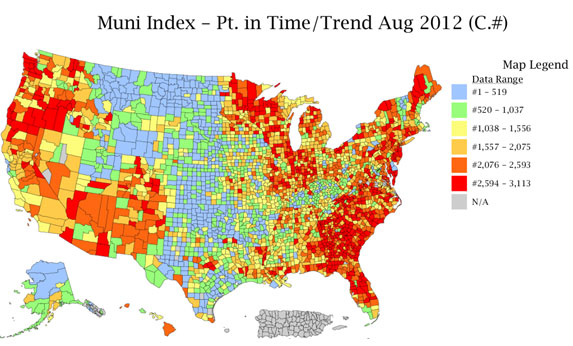

Munis must be treated like any other investment. Look at the underlying value—the fundamentals. That is where Lumesis comes in. With over 130 data sets parsed down to the state and municipal level and a complete categorization of all 1.4 million muni bonds in the U.S., Lumesis is the “Capital IQ” of the muni bond market. Lumesis allows institutions and individuals to quickly identify risks and opportunities in the haystack that is the muni bond market.